Healthcare in the United States can be complex and costly. One of the most critical concepts to grasp when evaluating your health insurance plan is the “out-of-pocket maximum.” If you’ve ever been confused by what this term means, how it works, or how it affects your overall healthcare costs, you’re not alone. In this detailed guide, we will dive deep into understanding out of pocket maximums and how they can play a pivotal role in your financial planning and healthcare decisions.

What Is an Out of Pocket Maximum?

The out-of-pocket maximum is the highest amount you have to pay for covered healthcare services in a plan year before your health insurance begins to pay 100% of the allowed amount. This limit protects you from excessive medical expenses and ensures that once your spending reaches a certain threshold, your insurer takes over the rest.

This maximum includes:

- Deductibles

- Copayments

- Coinsurance

It does not include:

- Premiums

- Out-of-network care (in many cases)

- Services not covered by your insurance plan

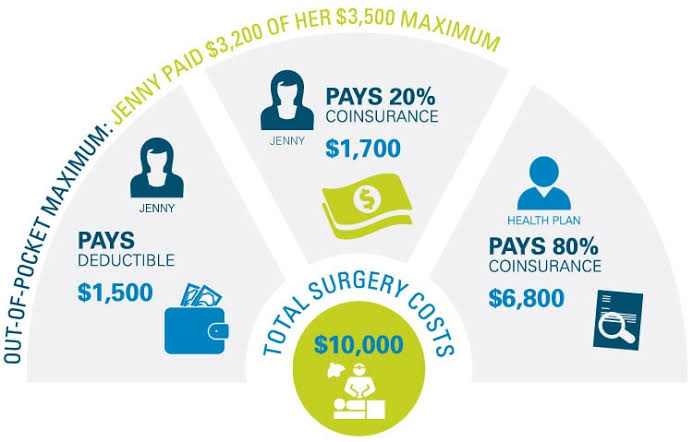

Example:

If your health insurance plan has an out-of-pocket maximum of $8,550, once you’ve spent that amount in deductibles, copays, and coinsurance, your insurance will pay 100% of covered medical costs for the remainder of the year.

Why Understanding Out of Pocket Maximums Is Important

Understanding out of pocket maximums is essential for several reasons:

- Budget Planning: Knowing your maximum liability helps you financially prepare for the worst-case scenario.

- Choosing the Right Plan: Helps you compare health plans more effectively.

- Avoiding Surprises: Prevents unexpected costs when you know what expenses count toward the maximum.

- Healthcare Decisions: Allows you to make informed decisions about treatments, procedures, and medications.

Key Terms to Understand

To fully understand out-of-pocket maximums, it’s important to familiarize yourself with related terms:

Premium

The monthly amount you pay for your health insurance coverage.

Deductible

The amount you pay for covered health care services before your insurance starts to pay.

Copayment (Copay)

A fixed amount you pay for a covered health care service after you’ve paid your deductible.

Coinsurance

The percentage of costs you pay after you’ve met your deductible.

Allowed Amount

The maximum amount your insurer will consider for a covered service.

Out of Pocket Maximum vs. Deductible

It’s easy to confuse a deductible with an out-of-pocket maximum, but they serve different functions:

- Deductible: The amount you pay before your insurance begins to share the cost.

- Out-of-Pocket Maximum: The ceiling on how much you will pay in a year for covered services.

Example:

- Deductible: $2,000

- Out-of-Pocket Max: $7,500

Once you’ve spent $2,000, you start paying coinsurance. If your coinsurance is 20%, you continue paying 20% of medical costs until your total spending hits $7,500. After that, insurance covers everything.

Annual Limits for 2025 (Example Figures)

The U.S. Department of Health and Human Services (HHS) sets limits on out-of-pocket maximums each year. For 2025, the limits are:

- Individual coverage: $9,450

- Family coverage: $18,900

These numbers may vary slightly by plan and insurer, but these are the maximum thresholds.

What Counts Toward Your Out of Pocket Maximum?

Generally, the following expenses count:

- Deductibles

- Copayments

- Coinsurance

- Prescription drugs (if part of your plan)

- Emergency services

- In-network doctor visits and procedures

What Usually Doesn’t Count:

- Monthly premiums

- Out-of-network care (unless specified)

- Non-covered services

- Balance billing charges from out-of-network providers

How It Works Throughout the Year

Here is a step-by-step example to understand how your costs accumulate toward your out-of-pocket maximum:

- January: You visit a doctor and pay the full cost because you haven’t met your deductible.

- March: You have a minor surgery and reach your deductible.

- June: You pay coinsurance for hospital follow-up visits.

- August: You reach your out-of-pocket maximum.

- September to December: Your insurance covers 100% of all further in-network covered services.

Out of Pocket Maximum and Prescription Drugs

Many health plans include prescription drug costs in your out-of-pocket maximum. This is particularly helpful if you have high medication expenses. Check your Summary of Benefits to see how your plan handles prescriptions.

Out of Pocket Maximum in Family Plans

Family plans have both individual and family out-of-pocket maximums:

- Individual maximum: Each member has a cap. Once they reach it, their costs are covered 100%.

- Family maximum: Once the total out-of-pocket expenses for all members combined reach this amount, the plan pays 100% for everyone.

Example:

- Individual Max: $9,450

- Family Max: $18,900

If one member spends $9,450, their future costs are covered. If the rest of the family together spends $9,450, everyone’s covered costs are 100% covered for the year.

High-Deductible Health Plans (HDHPs) and Out of Pocket Maximums

HDHPs often come with higher out-of-pocket maximums but lower premiums. They are compatible with Health Savings Accounts (HSAs), which can be used to pay out-of-pocket costs.

Pros:

- Lower premiums

- HSA compatibility

Cons:

- Higher initial costs until you meet the deductible

- Higher out-of-pocket maximum

Comparing Plans Using Out of Pocket Maximums

When shopping for health insurance plans, don’t just look at the premium. Compare the out-of-pocket maximums too. Two plans may have similar premiums but drastically different out-of-pocket costs.

Example Comparison:

| Feature | Plan A | Plan B |

|---|---|---|

| Monthly Premium | $300 | $450 |

| Deductible | $2,000 | $1,000 |

| Out-of-Pocket Max | $8,000 | $4,000 |

If you expect high medical costs, Plan B might save you money overall despite the higher premium.

Out of Pocket Maximums and Medicare

Traditional Medicare (Part A and Part B) does not have an out-of-pocket maximum. However, Medicare Advantage plans (Part C) do include an out-of-pocket maximum, which can provide better financial protection.

In 2025, Medicare Advantage plans have a maximum limit of $8,850 for in-network services.

ACA Requirements and Protections

The Affordable Care Act (ACA) mandates that all ACA-compliant health insurance plans include an out-of-pocket maximum. This provision is one of the key consumer protections built into the law.

Key Benefits:

- Financial protection from catastrophic medical costs

- Standardized limits updated annually

- Applies to essential health benefits

Tips to Manage Your Out of Pocket Costs

1. Choose the Right Plan

Evaluate your health needs. If you expect regular visits and prescriptions, a lower out-of-pocket max may be better, even with a higher premium.

2. Use In-Network Providers

Out-of-network care often doesn’t count toward your maximum and can be very expensive.

3. Maximize Preventive Care

Most health plans cover preventive services at no cost to you. Utilize these to catch issues early.

4. Keep Track of Expenses

Save all medical bills and EOBs (Explanation of Benefits) to ensure costs are being correctly credited toward your out-of-pocket maximum.

5. Use an HSA or FSA

These accounts can be used to pay for qualifying out-of-pocket expenses with pre-tax dollars.

Common Myths About Out of Pocket Maximums

Myth 1: My premiums count toward my out-of-pocket maximum.

Fact: Premiums are not included.

Myth 2: Once I hit my deductible, everything is covered.

Fact: After the deductible, you usually still pay coinsurance or copays until the out-of-pocket max is reached.

Myth 3: All medical costs count toward the out-of-pocket max.

Fact: Only eligible, in-network, covered services are counted.

Final Thoughts

Understanding out of pocket maximums is critical to making informed decisions about your healthcare coverage. While health insurance terminology can seem intimidating, mastering these key financial concepts can save you thousands of dollars and help you plan more effectively for medical expenses.

By comparing plans carefully, knowing what counts toward your maximum, and strategically using tools like HSAs and FSAs, you can navigate your healthcare costs more confidently and with less financial stress.

If this article was informative also checkout: Do Renters Really Need Insurance

also checkout: Click Here