Comprehensive vs Collision Coverage is a common point of confusion for many drivers shopping for car insurance. Both types of coverage fall under the broader category of auto insurance, and while they are optional in most states, they play a crucial role in protecting your vehicle from damage. Understanding the distinction between these coverages can help you make informed decisions and potentially save money in the long run. In this comprehensive guide, we will explore the definitions, differences, scenarios, costs, and when to choose each coverage type.

Understanding Comprehensive Coverage

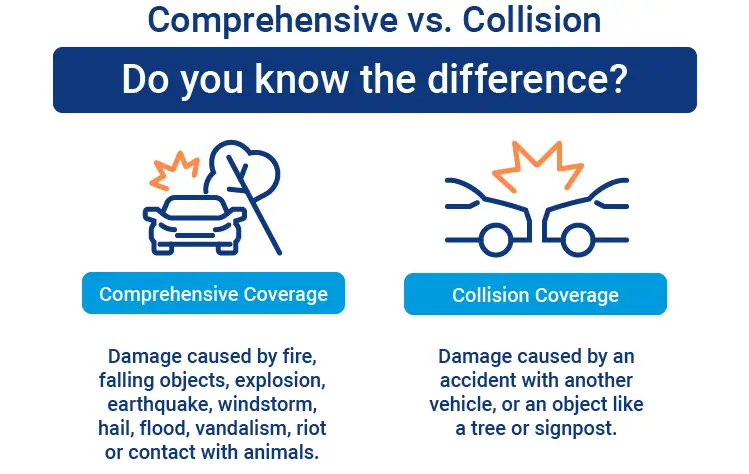

Comprehensive coverage helps pay for damage to your car that isn’t caused by a collision. Think of it as protection against events beyond your control.

Events Typically Covered by Comprehensive Coverage:

- Theft

- Vandalism

- Fire

- Natural disasters (floods, hurricanes, earthquakes)

- Falling objects (tree branches, debris)

- Animal-related damage (like hitting a deer)

- Civil disturbances (riots, vandalism)

If your vehicle is damaged or destroyed due to one of these covered events, comprehensive insurance helps cover the cost of repairs or replacement, minus your deductible.

Understanding Collision Coverage

Collision coverage helps pay for damage to your car resulting from a collision, regardless of who is at fault.

Scenarios Typically Covered by Collision Coverage:

- Hitting another vehicle

- Getting hit by another vehicle

- Single-car accidents (e.g., hitting a tree or a pole)

- Rolling your vehicle

This coverage is especially important if your car is newer or financed, as it helps you repair or replace your vehicle after an accident.

Comprehensive vs Collision Coverage: Key Differences

| Feature | Comprehensive Coverage | Collision Coverage |

|---|---|---|

| Type of Event | Non-collision events (theft, weather, animals) | Collision events (crashes) |

| Fault | Doesn’t matter | Doesn’t matter |

| Deductible | Yes | Yes |

| Required by Lender | Sometimes | Often |

| Impact on Premium | Generally lower | Typically higher |

While both coverages are optional, leasing or financing a vehicle may require you to carry both.

Do You Need Both Comprehensive and Collision Coverage?

Whether you need both depends on several factors:

- Value of Your Vehicle: If your car is new or holds significant value, both coverages are often worth the cost.

- Loan or Lease Requirements: Lenders typically require full coverage, which includes both comprehensive and collision.

- Driving Habits: If you drive frequently or in high-risk areas, the protection of both coverages may be beneficial.

- Local Risks: Living in an area prone to natural disasters or high crime rates can justify comprehensive coverage.

- Budget for Repairs: If you can’t afford unexpected repair costs, maintaining both coverages may offer peace of mind.

Cost Differences Between Comprehensive and Collision Coverage

Premiums for comprehensive and collision coverage vary based on several factors:

- Vehicle make, model, and year

- Location

- Driving history

- Claims history

- Deductible amount

Typically, collision coverage costs more than comprehensive due to the frequency and severity of accidents.

Sample Premium Comparison (Annual Averages):

- Comprehensive: $150 to $250

- Collision: $300 to $500

Your actual costs may differ, so it’s essential to get personalized quotes.

Deductibles and Claims Process

Both coverages come with deductibles, which is the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles usually mean lower premiums, but more out-of-pocket costs at the time of a claim.

Claim Process for Comprehensive or Collision Coverage:

- Contact your insurance company immediately after the incident.

- Provide details and documentation (photos, police report).

- An adjuster assesses the damage.

- You pay your deductible.

- The insurer pays for repairs or replacement (up to the car’s actual cash value).

Real-Life Scenarios

- Comprehensive Example: A hailstorm dents your car overnight. Your comprehensive coverage will handle the repairs.

- Collision Example: You rear-end another vehicle at a stoplight. Collision coverage pays for your vehicle’s repairs.

- Both Apply: You hit a deer and swerve into a tree. Comprehensive covers the animal hit, and collision covers the impact with the tree.

When to Drop Comprehensive or Collision Coverage

As your car ages and its value depreciates, you may consider dropping one or both coverages.

General Guidelines:

- If your vehicle’s value is less than 10 times the premium, it might not be worth keeping.

- Consider dropping collision before comprehensive, as the latter is usually cheaper and covers a broader range of scenarios.

- Always evaluate your financial ability to replace or repair your car without insurance.

Tips for Choosing the Right Coverage

- Assess Your Vehicle’s Value: Use online tools like Kelley Blue Book to estimate value.

- Consider Local Risks: Think about weather patterns, crime rates, and wildlife.

- Review Financial Needs: Can you afford high deductibles or out-of-pocket expenses?

- Compare Insurers: Get multiple quotes to find the best rates and service.

- Bundle Policies: Combining auto with home or renters insurance can reduce costs.

Common Myths Debunked

- Myth: Comprehensive means full coverage

- Fact: It only covers non-collision-related damage.

- Myth: You only need one of the two

- Fact: They cover different risks; one doesn’t replace the other.

- Myth: Your insurance pays the full replacement value

- Fact: Payouts are based on the actual cash value, not what you paid.

Final Thoughts

Understanding the distinction between Comprehensive vs Collision Coverage is essential for making smart insurance decisions. While both are optional, they offer valuable protection depending on your personal circumstances. Evaluate your vehicle’s value, financial situation, and local risks before selecting or dropping these coverages. When in doubt, consult with an insurance agent who can help tailor a policy that meets your needs and budget.

By being informed, you can ensure that you’re adequately protected without overpaying for unnecessary coverage.

If this article was informative also checkout: What Affects Your Car Insurance Rates

also checkout: Click Here