When it comes to planning for the financial future of your loved ones, choosing the right type of life insurance is one of the most critical decisions you can make. Among the many options available, two of the most commonly compared policies are Term Life Insurance and Whole Life Insurance. Each has its unique features, benefits, and drawbacks. In this comprehensive guide, we will break down the key differences between Term and Whole Life Insurance, explore their pros and cons, and help you determine which one may be better suited to your needs.

What Is Life Insurance?

Life insurance is a contract between you and an insurance company. In exchange for regular premium payments, the insurer promises to pay a designated beneficiary a sum of money (the death benefit) upon your death. This financial protection can cover final expenses, replace lost income, pay off debts, or support long-term financial goals.

Understanding Term Life Insurance

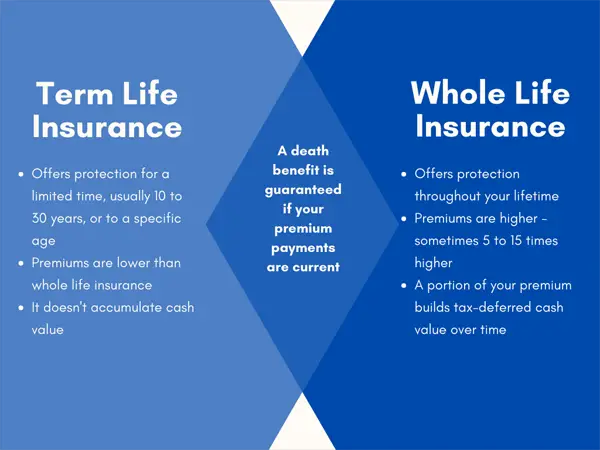

Term Life Insurance provides coverage for a specific period, typically 10, 20, or 30 years. If the policyholder dies during the term, the beneficiary receives the death benefit. If the policyholder outlives the term, there is no payout unless the policy is renewed.

Key Features:

- Affordability: Lower premiums compared to whole life insurance.

- Simplicity: Straightforward coverage with no investment component.

- Temporary Coverage: Ideal for covering financial responsibilities during specific life stages, such as raising children or paying off a mortgage.

Pros:

- Cost-effective for large coverage amounts

- Easy to understand

- Flexible policy terms

Cons:

- No cash value accumulation

- Coverage ends when the term expires

- Renewal can be expensive or unavailable depending on age and health

Understanding Whole Life Insurance

Whole Life Insurance offers lifelong coverage, as long as premiums are paid. In addition to the death benefit, it includes a savings or investment component known as “cash value,” which grows tax-deferred over time.

Key Features:

- Lifelong Protection: Coverage does not expire as long as premiums are maintained.

- Cash Value: A portion of your premium builds savings that can be borrowed against or withdrawn.

- Level Premiums: Premiums remain the same throughout the policyholder’s life.

Pros:

- Guaranteed death benefit and fixed premiums

- Builds cash value over time

- May pay dividends depending on the insurer

Cons:

- Higher premiums compared to term life

- Can be complex with investment elements

- Lower initial coverage for the same premium

Key Differences Between Term and Whole Life Insurance

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Duration | Temporary (10-30 years) | Lifelong |

| Premium Cost | Lower | Higher |

| Cash Value | No | Yes |

| Flexibility | Limited to term | Offers investment and loan options |

| Complexity | Simple | More complex |

When to Choose Term Life Insurance

Term Life Insurance might be the better choice if:

- You need coverage for a specific time period (e.g., until your children are grown or your mortgage is paid).

- You are looking for the most affordable option.

- You prefer a straightforward policy without the complexities of cash value.

Ideal candidates for term life include:

- Young families with tight budgets

- Homeowners with large mortgages

- Individuals with temporary financial obligations

When to Choose Whole Life Insurance

Whole Life Insurance might be more suitable if:

- You want lifelong protection.

- You’re interested in building cash value as part of your financial strategy.

- You seek a policy with fixed premiums and guaranteed payouts.

Ideal candidates for whole life include:

- Individuals with long-term dependents

- Those interested in estate planning

- People looking for tax-deferred investment options

Financial Comparison: Term vs. Whole Life Insurance

Let’s say a 30-year-old non-smoker wants $500,000 in coverage:

- Term Life (20-year): Approximately $25/month

- Whole Life: Approximately $300/month

In 20 years, term life costs $6,000 total, while whole life costs $72,000—but the latter includes cash value that may be partially recoverable.

Common Misconceptions

1. Whole Life Is Always Better Because It Lasts Forever: Not necessarily. The higher cost may not justify the lifetime coverage for everyone.

2. Term Life Is Wasted Money: Just like car insurance, term life protects against risk. If you outlive it, that means you’re alive—which is not a bad thing!

3. You Can’t Convert Term to Whole Life: Many term policies include a conversion feature that lets you switch to whole life without a medical exam.

The Hybrid Option: Universal Life Insurance

If you’re undecided, consider Universal Life Insurance—a flexible policy that blends elements of both term and whole life. It allows adjustable premiums and death benefits and includes a cash value component.

Expert Tips for Choosing Between Term and Whole Life

- Evaluate Your Financial Goals: Are you trying to protect your family’s immediate future or build long-term wealth?

- Consider Your Budget: Term life may free up money for other investments, while whole life offers stability.

- Think About Your Dependents: Do you have young children or dependents who will need lifelong care?

- Review Annually: As your life circumstances change, so may your insurance needs.

Final Thoughts

Choosing between Term Life and Whole Life Insurance is not about which one is universally better—it’s about what’s better for you. Term life offers affordable, straightforward protection for temporary needs, while whole life provides lifelong coverage and a cash value component that can support long-term financial planning.

Assess your personal situation, consult with a licensed insurance advisor, and weigh the pros and cons carefully. With the right information, you can confidently choose the best type of Life Insurance to protect your loved ones and secure your financial legacy.

If this article was informative also checkout: Health Insurance

also checkout: Click Here