Homeownership comes with a sense of pride, stability, and responsibility. Protecting your investment is crucial, and that’s where homeowners insurance comes in. Whether you’re a first-time buyer or a seasoned property owner, understanding what homeowners insurance covers is essential. This comprehensive guide will walk you through everything you need to know about what homeowners insurance covers, why it’s important, and how to ensure you’re adequately protected.

What Is Homeowners Insurance?

Homeowners insurance is a financial protection policy designed to cover losses and damages to your home and personal belongings due to various risks. It also provides liability coverage against accidents that occur on your property. While it’s not legally required in most places, mortgage lenders typically mandate it to protect their investment.

Key Components of Homeowners Insurance Coverage

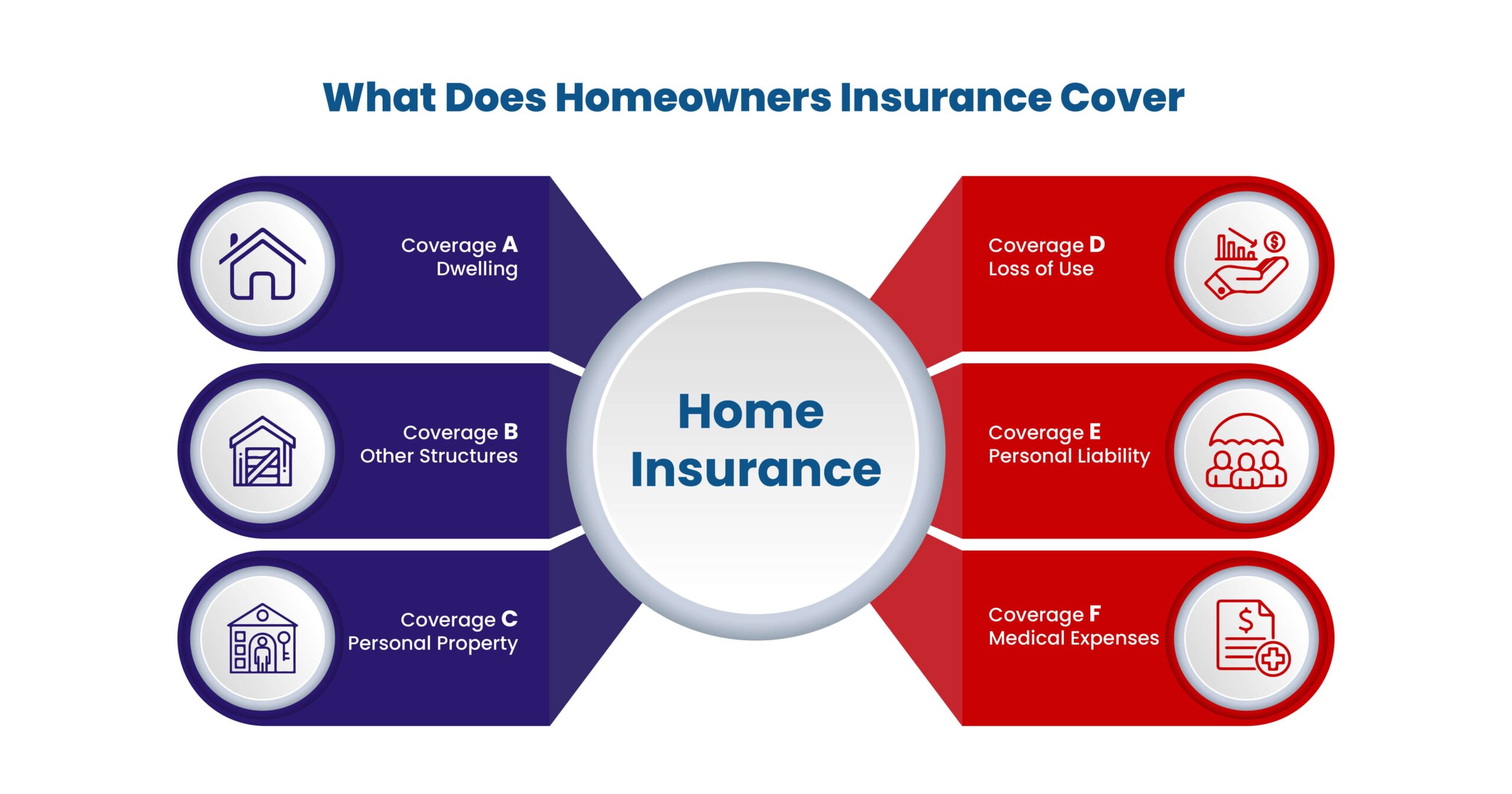

Homeowners insurance is typically broken down into several distinct types of coverage, each serving a specific purpose:

1. Dwelling Coverage

This is the core component of a homeowners insurance policy. Dwelling coverage pays to repair or rebuild your home if it’s damaged by covered perils such as:

- Fire and smoke

- Hail or windstorms

- Lightning strikes

- Explosions

- Vandalism

- Theft

- Damage from vehicles or aircraft

- Falling objects

- Weight of snow or ice

Dwelling coverage includes the physical structure of the home, including walls, roof, floors, built-in appliances, and attached structures like garages.

2. Other Structures Coverage

This covers buildings not attached to your home, such as:

- Detached garages

- Sheds

- Fences

- Gazebos

Generally, this coverage is around 10% of your total dwelling coverage but can be increased depending on your needs.

3. Personal Property Coverage

If your belongings are damaged or stolen due to a covered peril, personal property coverage can help replace or repair them. This includes:

- Furniture

- Clothing

- Electronics

- Appliances

- Tools

- Jewelry (up to a certain limit)

It’s important to take inventory and consider additional riders for high-value items not fully covered under a standard policy.

4. Liability Protection

Liability coverage protects you against legal responsibility if someone is injured on your property or if you accidentally damage someone else’s property. It can help cover:

- Legal fees

- Medical bills

- Lost wages

- Court judgments

Typical policies offer $100,000 in liability coverage, but you can increase this amount based on your assets.

5. Medical Payments Coverage

This covers minor medical expenses for guests injured on your property, regardless of fault. It’s not meant for you or household members, and typical limits are between $1,000 and $5,000.

6. Loss of Use (Additional Living Expenses)

If your home becomes uninhabitable due to a covered event, this part of your insurance can pay for temporary living expenses, such as:

- Hotel stays

- Restaurant meals

- Laundry services

- Transportation

This ensures you can maintain your standard of living while your home is being repaired or rebuilt.

Covered Perils in Homeowners Insurance

Standard homeowners insurance policies (often referred to as HO-3 policies) cover a wide range of perils. Some of the most commonly covered include:

- Fire and smoke

- Theft

- Vandalism

- Windstorms and hail

- Lightning

- Ice or snow weight

- Sudden water damage (e.g., burst pipes)

- Falling objects

However, there are notable exclusions which require separate policies or endorsements.

Common Exclusions: What Homeowners Insurance Does Not Cover

Despite its broad protection, homeowners insurance does not cover every possible risk. Some common exclusions include:

- Floods (requires a separate flood insurance policy)

- Earthquakes (may need earthquake insurance)

- Sewer backup

- Mold and mildew (unless sudden and accidental)

- Pest infestations (termites, rodents)

- Normal wear and tear

- Neglect or poor maintenance

- Intentional damage

Understanding these exclusions helps you determine whether you need additional policies or endorsements to stay fully protected.

Optional Add-Ons and Endorsements

To enhance your coverage, many insurers offer optional endorsements (also known as riders). These allow you to tailor your policy to your specific needs:

1. Scheduled Personal Property

For high-value items such as:

- Jewelry

- Fine art

- Antiques

- Musical instruments

2. Water Backup Coverage

Covers damage from sewer or sump pump backups.

3. Equipment Breakdown Coverage

Protects home systems and appliances from mechanical or electrical breakdown.

4. Identity Theft Protection

Helps cover expenses related to restoring your identity after theft or fraud.

5. Home Business Endorsement

Provides limited protection for business equipment or liability related to a home business.

How Much Coverage Do You Need?

Determining the right amount of coverage is crucial. Consider the following when choosing limits:

- Rebuilding Cost: Ensure your dwelling coverage reflects the full cost to rebuild your home.

- Contents Value: Create an inventory of your personal belongings.

- Liability Risks: Higher liability limits protect your financial future.

- Lifestyle and Family Size: More people usually means more belongings and greater liability exposure.

Speak with an insurance professional to tailor coverage based on your needs.

How to File a Claim

When disaster strikes, knowing how to file a claim can make a stressful time more manageable:

- Document the Damage: Take photos and videos.

- Contact Your Insurer: Report the incident as soon as possible.

- Fill Out Required Forms: Complete any necessary claim paperwork.

- Meet with the Adjuster: They’ll assess the damage and determine payouts.

- Track Expenses: Keep receipts for any repairs or temporary accommodations.

- Receive Compensation: Your insurer will process the claim and provide payment based on your policy terms.

Tips for Getting the Most Out of Your Homeowners Insurance

- Review Your Policy Annually: Update coverage as your home value or contents change.

- Bundle Policies: Combine auto and home insurance for discounts.

- Maintain Your Property: Insurers may deny claims due to neglect.

- Increase Your Deductible: A higher deductible can lower your premium.

- Install Safety Features: Security systems, smoke detectors, and fire extinguishers can reduce risk and costs.

The Role of Insurance in Financial Security

Homeowners insurance isn’t just a contract—it’s a safety net that protects your home, possessions, and financial well-being. A well-structured policy can shield you from devastating out-of-pocket expenses and provide peace of mind knowing you’re covered for life’s unexpected events.

It also plays a vital role in risk management and estate planning, especially if your property is a significant part of your financial portfolio.

Final Thoughts

Understanding what homeowners insurance covers—and what it doesn’t—is a key step in protecting your investment and ensuring long-term financial stability. While policies vary, they generally include coverage for the dwelling, other structures, personal belongings, liability, and additional living expenses. Always read your policy carefully, assess your needs, and consider extra coverage options for full protection.

By taking a proactive approach and staying informed, you can confidently secure your home and everything in it. When in doubt, consult a licensed insurance agent to guide you through the process.

if this article was informative also checkout: Common Insurance Terms